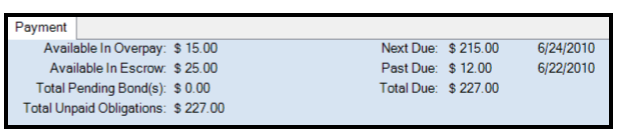

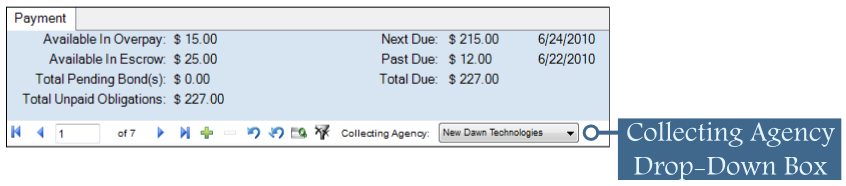

The Payment snap-in header provides concise financial information at a glance.

Remember: Only financial records associated with the collecting agency to which you are currently logged on will appear in this header. Use the Collecting Agency drop-down box to switch between agencies of which you are a member.

Each field in the Payment snap-in header displays key pieces of information.

Related Topics

Related Topics